mobile al sales tax rate 2019

The minimum combined 2022 sales tax rate for Mobile Alabama is. Local Tax Rate a Combined Rate Combined Rank Max Local Tax Rate.

Alabama Sales Use Tax Guide Avalara

Income Tax Rate Indonesia.

. State of Alabama Sales Use Tax Information. No state rates have changed since July 2018 when Louisianas declined from 50 to 445 percent. Has impacted many state nexus laws and sales tax collection requirements.

The Mobile County Sales Tax is collected by the merchant on all qualifying sales made within Mobile County. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee. The five states with the highest average combined state and local sales tax rates are Tennessee 947 percent Louisiana 945 percent Arkansas 943 percent Washington 917 percent and Alabama 914 percent.

Alabama Legislative Act 2010-268. What is the sales tax rate in Mobile Alabama. INSIDE MobilePrichard OUTSIDE MobilePrichard UNABATED EDUCATION LODGING.

The 2018 United States Supreme Court decision in South Dakota v. Mobile County AL Sales Tax Rate. Mobile County collects a 15 local sales tax less than.

This is the total of state and county sales tax rates. This is the total of state county and city sales tax rates. The Alabama sales tax rate is currently.

For tax rates in other cities see Alabama sales taxes by city and county. Revenue Forms and Applications. The Mobile Alabama sales tax is 1000 consisting of 400 Alabama state sales tax and 600 Mobile local sales taxesThe local sales tax consists of a 150 county sales tax and a 500 city sales tax.

Mobile al sales tax rate 2019. Mobile Al Sales Tax Rate 2019. 24 rows sales tax.

The Mobile Sales Tax is collected by the merchant on all qualifying sales made within Mobile. The County sales tax rate is. The Mobile County Sales Tax is 15.

There is no applicable special tax. The Alabama state sales tax rate is currently. Online Filing Using ONE SPOT-MAT.

Alabama has 295 seperate areas each with their own Sales Tax rates with the lowest Sales Tax rate in Alabama being 4 and the highest Sales Tax rate in Alabama at 10. Section 34-22 Provisions of state sales tax statutes applicable to article states. You can print a 10 sales tax table here.

The five states with the highest average combined state and local sales tax rates are Tennessee and Arkansas 947 percent Louisiana 945 percent Washington 921 percent and Alabama 916 percent. Mobile AL 36652-3065 Office. No other state rates have changed since July 2018.

The Mobile County sales tax rate is. Mobile collects a 6 local sales tax the maximum local sales tax allowed under. A county-wide sales tax rate of 15 is applicable.

MOBILE COUNTY TAX RATES. State and Local Sales Tax Rates as of January 1 2019 State State Tax Rate Rank Avg. By Jan 19 2021 G2 OpenBook 0 comments Jan 19 2021 G2 OpenBook 0 comments.

AL Sales Tax Rate. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23fee 150 minimum for each registration year renewed as well as 100. Delivery Spanish Fork Restaurants.

Impingement inklämd sena. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent. How Does Sales Tax in Mobile compare to the rest of Alabama.

The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe local sales tax consists of a 150 county sales tax. 4 rows Rate. Soldier For Life Fort Campbell.

The minimum combined 2022 sales tax rate for Mobile County Alabama is. Utahs statewide rate increased from 595 percent to 61 percent in April 2019. Mobile al sales tax rate 2019.

Essex Ct Pizza Restaurants. Monday Tuesday Thursday Friday. The 10 sales tax rate in Mobile consists of 4 Alabama state sales tax 1 Mobile County sales tax and 5 Mobile tax.

Opry Mills Breakfast Restaurants. Enero 19 2021 en Uncategorized por. Begränsade öppettider under sommaren samt julhelger.

Restaurants In Matthews Nc That Deliver.

Sales And Use Tax Rates Houston Org

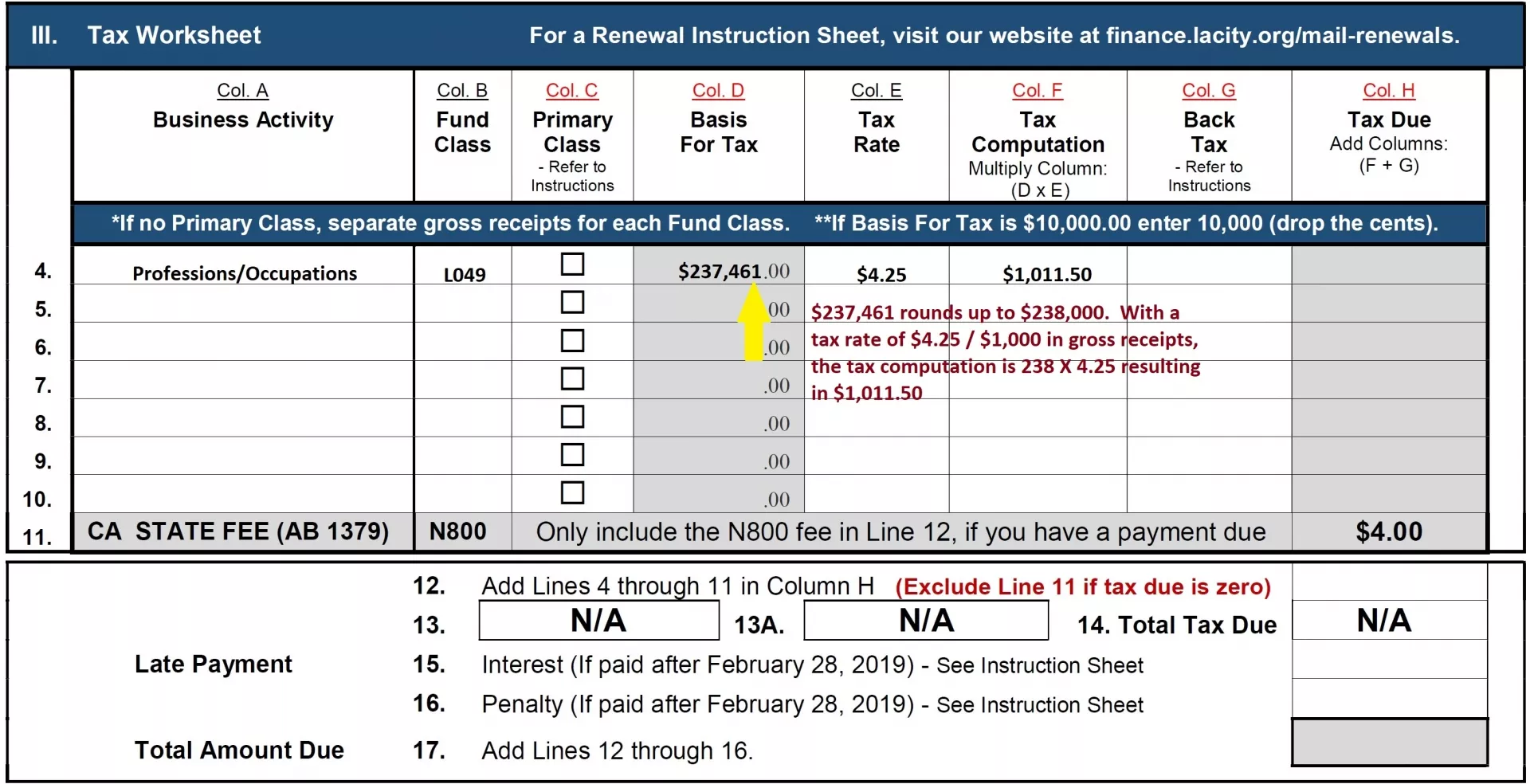

Business Tax Renewal Instructions Los Angeles Office Of Finance

Alabama Sales Tax Rates By City County 2022

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sales Tax On Grocery Items Taxjar

How Do State And Local Sales Taxes Work Tax Policy Center

Locations Mobile County Revenue Commission

States With Highest And Lowest Sales Tax Rates

How Do State And Local Sales Taxes Work Tax Policy Center

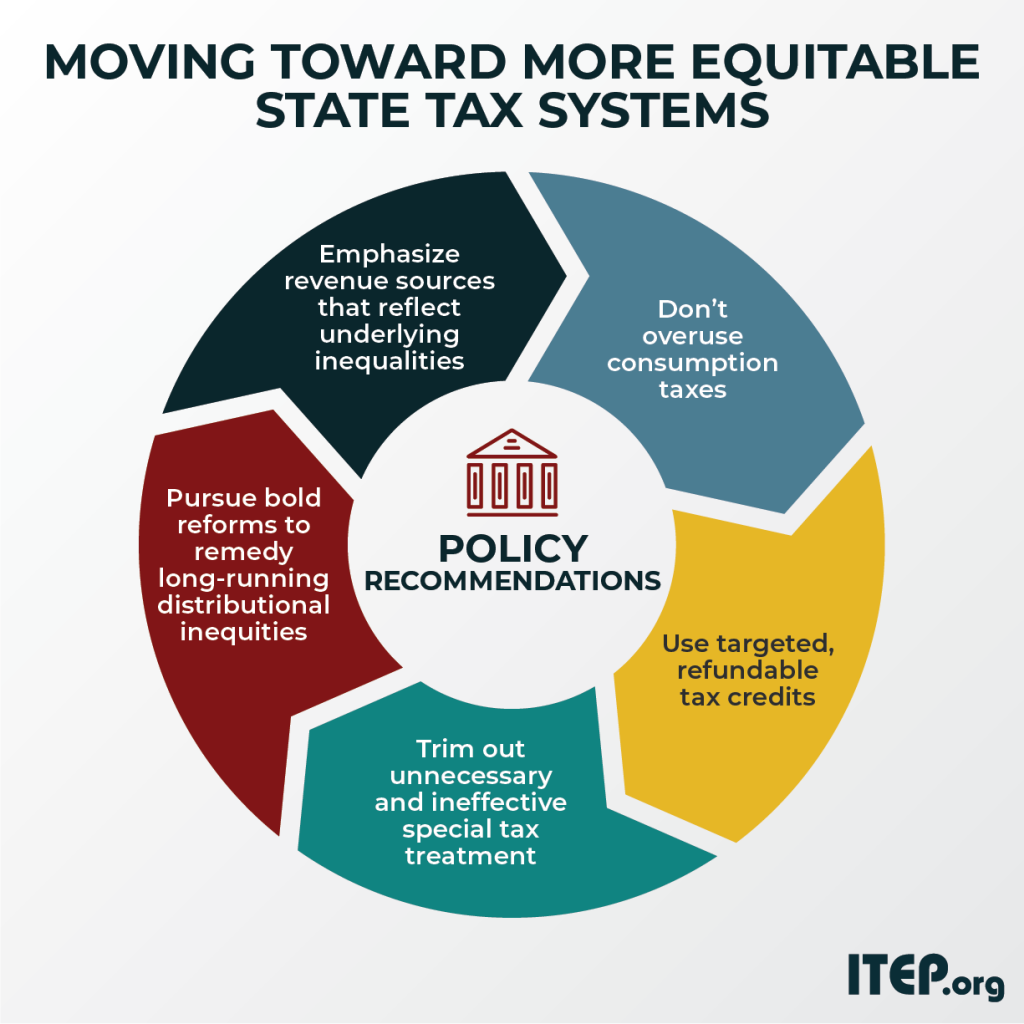

Moving Toward More Equitable State Tax Systems Itep

North Carolina Sales Tax Small Business Guide Truic

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)